-

Crucial Steps When Buying A Business

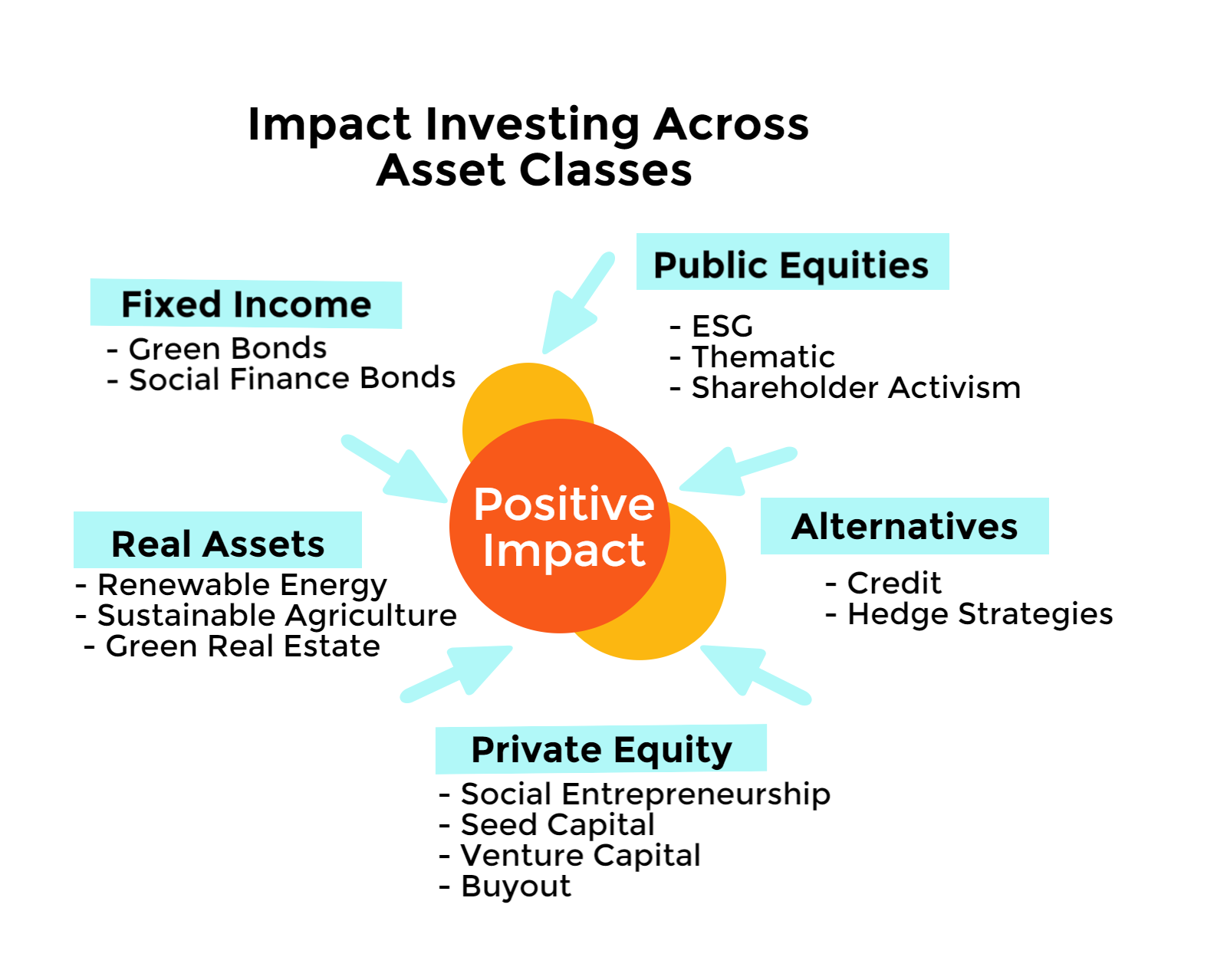

Based upon our experience, impact financial investments are most important at the earliest phases of development. It’s a time when outcomes are the least specific and entrepreneurs require the most assist. By infusing a launch with financial and human capital, we offer the business owner the time and resources they need to evaluate the market viability and social impact of their model.

For impact investing to reach its true potential, we need to likewise create the conditions for these ventures to take root. From industry associations to information exchanges, our investees are working to develop the needed infrastructure for a sector to prosper. We also deal with key choice makers to advocate for policy changes that motivate healthy market competition, develop appropriate regulations, and encourage an environment where entrepreneurship and development can prosper.

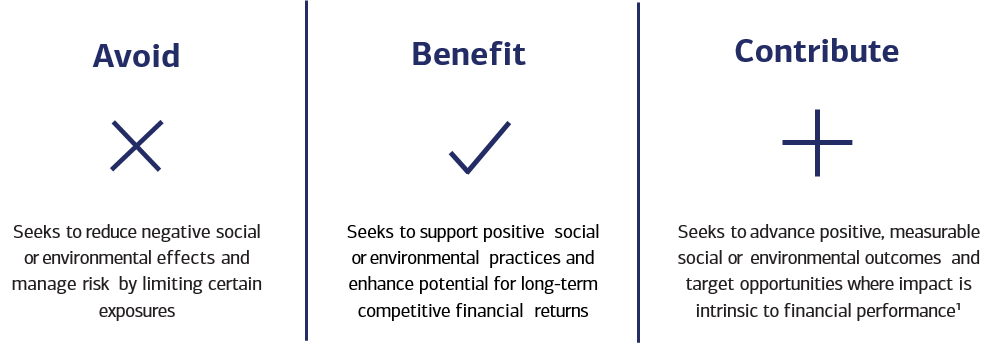

between society and company an urgent concern, numerous business and banks are eager to find investments that create company and social returns. One opportunity is “impact investing,” directing capital to business that produce social or ecological benefitsin tasks from affordable real estate to sustainable timberland and eye-care clinicsthat standard company designs often avoid.

Impact investing may be anticipated to grow to more than $300 billion by 2020, however even that would be a little portion of the $2.9 trillion or two that will likely be managed by private-equity (PE) companies worldwide in 2020. Our research in Indiaa testbed of new impact-investment ideas, where some 50 investors have poured $5.2 billion into projects considering that 2010 and investment is growing at a 14 percent annual clippresents a different perspective.

The findings recommend that as more companies and larger investors end up being familiarized with the real state of play, in India and in other places, they’ll find investment opportunities that align with their social and business goals (Tyler T. Tysdal). Impact investments in India have actually shown how capital can be used sustainably and how it can satisfy the monetary expectations of investors.

The top one-third of offers yielded a median IRR of 34 percent, plainly indicating that it is possible to achieve lucrative exits in social business. We sorted the exiting offers by sector: agriculture, clean energy, education, microfinance firms and others that work to increase financial inclusion, and health care. Almost 80 percent of the exits in monetary inclusion remained in the leading two-thirds of efficiency.

Cherry Creek Family

With a limited sample of just 17 exits outside monetary inclusion, however, it is too early to be definitive about the efficiency of the other sectors. Exhibit 1 reveals some evident relationships between deal size and volatility of returns, as well as general performance. The larger deals produced a much narrower series of returns, while smaller deals typically produced much better outcomes (Tyler Tivis Tysdal) (Tyler Tivis Tysdal).

These findings recommend that investors (especially those that have been reluctant) can select and pick their opportunities, according to their know-how in seeding, growing, and scaling social business. We make every effort to offer people with impairments equivalent access to our website (Tyler Tysdal Lone Tree). If you would like details about this material we will more than happy to work with you.

Offers yielded a large range of returns no matter the holding duration. Seen another way, this likewise suggests that social enterprises with strong organisation designs do not need long holding durations to produce value for investors. Social investment requires a wide variety of investors to make the most of social well-being; companies getting financial investment require different abilities as they progress (Tyler T. Tysdal).

For example, one financial investment in a dairy farm needed a round of riskier seed investment prior to becoming ideal to traditional investors (Tyler Tivis Tysdal). How impact investing can reach the mainstream Phase two require skills in stabilizing financial returns with social impact, in addition to the stamina to devote to and measure the dual bottom line.

We make every effort to supply individuals with specials needs equivalent access to our site. If you would like info about this material we will enjoy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey.com!.?.! Core impact investors were the first investors in 56 percent of all offers( Exhibit 2) and in 8 of the leading 10 microfinance institutions in India. Traditional PE and VC funds brought larger pools of capital, which accounted for about 70 percent of initial institutional funding by value. This is particularly essential for capital-intensive and asset-heavy sectors such as clean energy and microfinance. In general, mainstream funds contributed 48 percent of the capital throughout sectors( Exhibit 3). If you would like details about this content we will be happy to work with you. Please email us at: McKinsey_Website_Accessibility@mckinsey (Tyler T. Tysdal).com!.?.! Club deals that integrate impact investors and standard PE and VC funds contributed 32 percent of capital and highlight the complementary role of both kinds of investors. As business fully grown and impact investors stay involved, they are able to draw in funding from traditional funds. Nonprofits have generally been active longer than impact business and have actually developed economical systems for providing product or services and executing service plans. Impact investors could.

be seen as strategic investors in nonprofits, which in turn contribute in scale-up, talent tourist attraction, and the delivery of monetary and operating leverage. Impact financial investments touched the lives of 60 million to 80 million individuals in India. That’s comparable to the population of France, a figure that is much higher than the proverbial drop in the ocean numerous.

Creek Family Offices

think of impact financial investment to bemore like a small sea. To be sure, India has huge populations of individuals in need. As investors reconsider their understanding of impact investing, the capital commitments they make make sure to broaden. That will certainly provide new obstacles. However our research study suggests that this nascent property class can fulfill the financial obstacles in addition to accomplish the social returns sought by service providers of capital internationally.( Source: Mission Investors Glossary, unless otherwise noted )A benefit corporation is a new class of corporation that willingly meets greater standards of corporate purpose, accountability and openness. A benefit corporation has a corporate purpose to create a material positive influence on society and the environment; to consider the impact of its decisions, not only on shareholders, however likewise on workers, community and the environment; and to report annually on its general social and ecological performance against a 3rd celebration requirement. A business design that integrates a revenue-generating organisation with a part which creates social-value; coined by Jed Emerson and sometimes utilized interchangeably with triple bottom line and social enterprise; often referred to as combined return or blended financing. Return on an investment that compromises some monetary gain to attain a social benefit( Source: SSIR ). Investments that deliver financial returns and social and/or ecological impact. Elements which social investors might think about as part of their investment analysis as a way to evaluate whether their investments promote sustainable, reasonable and reliable practices and mitigate potential threats; ESG might be referred to as” ESG financial investments “or “responsible investing.”: An investment developed to lead to positive social or environmental advantages while producing monetary returns that are similar to comparable standard instruments. Tyler Tivis Tysdal.

-

Intelligent Outdoor Security Camera for Optimum Protection

You can receive signals and alerts from it and view the status of all your smart security items from the app. Like the majority of security apps it likewise lets you see security video footage from your cams and supplies the capability to arm or disarm your system from another location. You can also use the Vivint Sky app to set automation guidelines with other, suitable, smart home products. However, rather of connecting to your Wi-Fi router, the doorbell links rather to Vivint’s smart home control panel and the control panel links to your router. The doorbell supports two-way audio, and you can talk with visitors utilizing either your mobile device or the control panel – vivint’s smart home. By the exact same token, you can see thumbnails of every event and pick any of those thumbnails to play a recording in a larger window on either your mobile app or on Vivint’s control panel.

When you’re viewing a live stream from the doorbell, you can press a button at the bottom of the screen to bring up the interface for the security system, where you can equip or disarm the system, lock or unlock any of your clever locks, and open or close your connected overhead garage doors.

Vivint Smart Home Security System

Vivint Smart Home Security System You can also develop custom-made rules such as “record a clip with all electronic cameras when an alarm is set off;” “switch on my porch light when my doorbell finds a person at night, and turn it off thirty minutes later,” or perhaps “record a clip with my doorbell when my lorry is interrupted. complete equipment services.” However as I said early on: This level of sophistication, security, and automation isn’t cheap. https://www.youtube.com/embed/BmvzQasIU40

The kit consists of the aforementioned smart home hub, 2 door/window sensing units, a movement sensing unit, a water leakage detector, and a $100 credit for additional sensors. Month-to-month service costs begin at $39 and consist of professional monitoring. If you choose to fund the system purchase through Vivint, you’ll need to sign a service contract; no agreement is needed if you spend for the hardware up front.

Check out Vivint Security Canada reviews for additional information.

Note: When you buy something after clicking links in our posts, we may make a little commission. Read our affiliate link policy for more information (taxes local permit).

One of the main factors why this company is so popular is that it incorporates contemporary innovation and safety. 24/7 specialist surveillance and clever automation create an outstanding mix. Obviously, every service has its disadvantages. This review will take a look at the top priorities for Vivint in addition to its advantages and disadvantages.

The Best Smart Home Security Systems

Automated device combination Indoor and outdoor cams Live video feed Mobile app Sensors and detectors Smart locks and thermostat This monitoring company is one of the finest in the nation, according to customer reports. Together with its automatic innovation, the systems are cordless, and the devices are smooth and advanced – window sensors motion.

Including Loss Remote

The corporation was established in 1997 under the name APX Alarm Security Solutions, Inc. It rebranded in 2011 and was purchased by The Blackstone Group in 2012 for $2 billion. In 2014, it got Space Monkey, which concentrates on cloud-based storage. Today, it has more than 11,000 employees and is headquartered in Provo, Utah.

Vivint Smart Home Security Review

Vivint Smart Home Security Review

Not only that, however they have custom-made bundles that permit customers to produce a plan that best matches their requirements. Vivint Home Security customers get a keyring remote control that they can utilize to arm and deactivate their systems. Besides that, the device can tailored actions such as locking the doors or garage – vivints smart home.

Customers can pick from a variety of cameras that fit both interior and outside settings. additional equipment purchased. The design is streamlined and simple, plus consumers can access the video feed from a mobile phone. Then, they can save any live-streaming footage to the cloud for future reference. Part of the system’s smart home integration is syncing up with gadgets like the Amazon Alexa or Echo.

People can utilize this innovation to dim the lights, lock the doors, turn on the alarm, and more. This accessory deal with the Vivint items to help in reducing energy costs for customers. A more recent addition to the line-up, the thermostat can make suggestions for heating and A/C and is available through the control panel or app (outdoor security camera).

This produces a safe and secure system and gets rid of the need for pesky cables and wires. While the devices are outstanding, the business lacks landline connections, which can turn rural customers away. Households can have the included guarantee of understanding that there are skilled service technicians and professionals who are constantly on-call. These workers can assist with any connection or support issues and even dispatch the local authorities in case of an emergency.

All of the items come with a 120-day guarantee, so there is time to get a feel for the systems and identify whether they’re an excellent fit. Tech-lovers will find whatever they want and need with Vivint. This consists of movement detection, instant informs, voice recognition, wise device and mobile compatibility, and more.

The Sky Mobile App grants users 24/7 access to their systems, including camera and video feeds, voice commands, and synced integration. reviewed information redacted. Even when they’re far from house, they can establish alarms and gadgets to keep an eye on whatever at your house. Besides the typical motion sensing units and indoor electronic cameras, customers can select from a broad range of items and services.

Upfront Additional Equipment

Also, in spite of the modern devices, whatever is rather simple to set up. All of the packages come with state-of-the-art devices and a range of options. Things like add-ons and personalized offers are likewise offered for those who desire more. Detectors and sensors track motion, noise, and ecological triggers like rain Home automation integrations with Alexa, Echo, Google Assistant, and mor Sky 2 (services louisiana vivint).0 control panel seven-inch touchscreen with overall control of the system Smart locks and lighting remote-controlled and help lower utility expenses Video doorbell visuals and two-way audio for increased safety The following gizmos make it even easier for clients to monitor their property and get skilled assistance when essential.

You May Also Be Interested in These Particular Stories

reviews about AlsanaDamaged glass sets off an alarm whenever windows get smashed Carbon monoxide gas alerts of possible CO2 poisoning and syncs to the system Entryway detects motion and sound around doors and windows Freeze registers colder temperatures to alert house owners of possible frozen pipelines Garage door permits remote opening and closing Movement spots motion and informs house owners Smoke/Heat senses increases in temperature levels to notify of possible fires/overheating Water/Floods informs individuals of excess water levels This is the crown jewel of the enterprise’s equipment – speeds vivint services.

-

How Does A Private Equity Firm Increase Business Value?

Entering into private equity directly after an MBA is almost difficult unless you have actually done investment banking or private equity before the MBA. You could finish the MBA, utilize it to win a full-time financial investment banking job, and then hire for private equity functions, but that’s even more challenging than breaking in pre-MBA from investment banking.

Leading qualifications (grades, test scores, and university track record); A lot of and interview preparation; Something that makes you appear to be a human rather than a robotic; The capability to about companies and investments rather than just “selling” them. A strong with the firm PE firms are much smaller sized than banks, so “fit” and soft abilities are a lot more crucial.

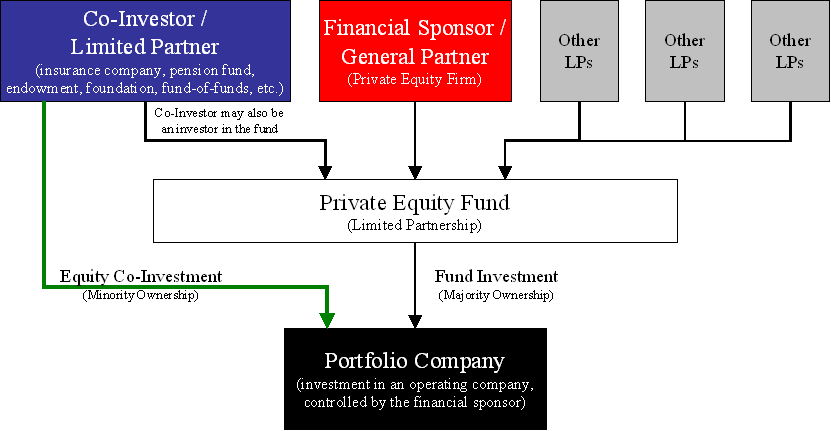

Like financial investment banks, Private Equity companies normally have a relatively stiff seniority structure with huge distinctions in experience level and duties from top to bottom. In general the senior-most specialists are accountable for deal sourcing, relationship management, and investment choice making, while the junior-most specialists bring the brunt of the analytical work.

This is, at least in part, because Private Equity companies tend to be much smaller than investment banking divisions at significant banks. As a result, junior experts will tend to have a lot more interaction with senior specialists, fostering a lot more chance to work straight with and learn straight from the most experienced experts in the firm.

The associate handles most of the financial modeling and preliminary due diligence for financial investment chances, while helping with the management and tracking of portfolio business as well as sourcing offers and supporting transactions. More day-to-day information on the partner’s function are offered later on in this guide. A majority of Pre-MBA partners (specifically in the United States) are hired for a two-year to three-year program. (Such a change would be sped up if the United States and other governments followed the lead of European nations in leveling the tax playing field.) Public companies might then gain from the chances afforded by a buy-to-sell strategy. Investors would benefit, too, as the higher competition in this space would create a more efficient marketone in which private equity partners were no longer so highly preferred over the investors in their funds.

You’ve most likely become aware of the term private equity (PE). Approximately $3.9 trillion in possessions were held by private equity companies since 2019, which was up 12.2 percent from the year before. Investors look for private equity funds to earn returns that are much better than what can attained in public equity markets. https://player.vimeo.com/video/445058690

Read on to learn more about private equity consisting of how it develops value and some of its essential strategies. Private equity refers to capital expense made into business that are not openly traded. The majority of private equity firms are open to recognized investors or those who are deemed high-net-worth, and successful private equity managers can make countless dollars a year.

Work With A Private Equity Firm – Dealforce

Private equity is ownership or interest in an entity that is not publicly noted or traded. A source of financial investment capital, private equity originates from high-net-worth people and firms that purchase stakes in private companies or obtain control of public companies with strategies to take them private, eventually delisting them from stock market (titlecard capital fund).

Due to the fact that private equity involves direct investmentoften to acquire influence or control over a business’s operationsa considerable capital investment is needed, which is why funds with deep pockets dominate the market. The minimum amount of capital required for certified investors can vary depending on the firm and fund. Some funds have a $250,000 minimum entry requirement, while others can need millions more.

Partners at private-equity firms raise funds and manage these cash to yield favorable returns for shareholders, generally with an financial investment horizon of between four and seven years. The private equity business draws in the very best and brightest in corporate America, including leading entertainers from Fortune 500 business and elite management consulting firms.

The fee structure for private-equity companies differs however typically includes a management and efficiency charge. An annual management charge of 2% of possessions and 20% of gross earnings upon sale of the company prevails, though incentive structures can vary significantly (securities fraud racketeering). Considered that a private-equity firm with $1 billion of possessions under management (AUM) may run out than 2 lots financial investment specialists, and that 20% of gross earnings can generate tens of millions of dollars in fees, it is easy to see why the market brings in top skill.

Principals, on the other hand, can earn more than $1 million in (recognized and latent) settlement each year. Private-equity firms have a series of investment preferences. Some are rigorous financiers or passive investors entirely depending on management to grow the business and produce returns. Due to the fact that sellers usually see this as a commoditized technique, other private-equity companies consider themselves active investors.

Active private equity companies might have a comprehensive contact list and C-level relationships, such as CEOs and CFOs within a provided industry, which can help increase earnings. They may likewise be experts in recognizing operational effectiveness and synergies. If a financier can bring in something special to an offer that will enhance the company’s worth over time, they are more most likely to be viewed favorably by sellers.

It is no surprise that the largest investment-banking entities such as Goldman Sachs (GS), JPMorgan Chase (JPM) and Citigroup (C) often help with the biggest deals – racketeering conspiracy commit. When it comes to private-equity companies, the funds they offer are just available to certified investors and might only enable a restricted variety of investors, while the fund’s founders will frequently take a rather big stake in the firm as well.

Private Equity Firms Start To Outline Pandemic Impact

For example, the Blackstone Group (BX) trades on the New York Stock Exchange (NYSE) and has actually been involved in the buyouts of business such as Hilton Hotels and MagicLab. Private-equity companies carry out 2 critical functions: offer origination/ deal executionportfolio oversight Offer origination includes developing, keeping and developing relationships with mergers and acquisitions (M&A) intermediaries, investment banks, and comparable transaction professionals to protect both high-quantity and top quality offer circulation.

Some companies work with internal staff to proactively determine and reach out to business owners to produce transaction leads. racketeering conspiracy commit. In a competitive M&A landscape, sourcing proprietary offers can help ensure that funds raised are successfully deployed and invested. Additionally, internal sourcing efforts can lower transaction-related expenses by eliminating the investment banking middleman’s fees.

As such, deal origination specialists attempt to develop a strong rapport with transaction specialists to get an early introduction to an offer. It is necessary to note that financial investment banks typically raise their own funds, and for that reason may not just be a deal recommendation, but also a completing bidder. Simply put, some financial investment banks take on private-equity companies in buying up excellent business.

Particular funds can have their own timelines, investment goals, and management viewpoints that separate them from other funds held within the exact same, overarching management firm. Effective private equity firms will raise many funds over their lifetime, and as companies grow in size and complexity, their funds can grow in frequency, scale and even uniqueness. To get more info regarding fund managers and also - research the videos and -.

Tyler Tysdal is a long-lasting entrepreneur assisting fellow entrepreneurs offer their company for optimum worth as Managing Director of Freedom Factory, the World’s Best Business Broker located in Denver, CO. Freedom Factory assists entrepreneurs with the greatest deal of their lives.

After the financial investment committee indications off to pursue a target acquisition candidate, the offer professionals submit an offer to the seller. If both parties choose to move on, the offer professionals work with various deal advisors to include financial investment lenders, accountants, legal representatives and specialists to execute the due diligence phase.

This part of the procedure is vital, as specialists can reveal deal-killers, such as significant and previously concealed liabilities and threats. There are a lot of private equity investment strategies – grant carter obtained. Two of the most typical are leveraged buyouts and venture capital financial investments. Leveraged buyouts are precisely how they sound. A target firm is bought out by a private equity firm.

The acquirer (the PE firm) seeks to purchase the target with funds gotten through the usage of the target as a sort of collateral. In a leveraged buyout, getting PE firms have the ability to purchase business with only needing to install a fraction of the purchase cost. private equity fund. By leveraging the investment, PE companies intend to optimize their possible return.

PE companies will typically see that potential exists in the market and more significantly the target firm itself, and often due to the absence of revenues, capital and debt financing readily available to the target. civil penalty $. Companies have the ability to take considerable stakes in such companies in the hopes that the target will develop into a powerhouse in its growing industry.

The Pros And Cons Of Having Private Equity Firms

Oversight and management comprise the second essential function of PE professionals. To name a few assistance work, they can stroll a young business executive personnel through best practices in strategic preparation and monetary management. In addition, they can assist institutionalise new accounting, procurement, and IT systems to increase the worth of their investment.

-

Is Your Business Ready For The Demands Of Private Equity?

This might be apparent from the staff member backgrounds (i.e. bulge brackets, technical degrees, and so on). In this case you must stress this skillset. Some other funds might look for more “simple” mindsets specifically as you decrease in financial investment size, and once again this might be evidenced by the dress code, more diverse backgrounds (i.e.

The reality is that you are able to anticipate with a fantastic degree of certainty a minimum of 80% of the interview concerns. For that reason, stopping working to give a clear and straight answer to questions about your deals, your CV, why private equity, why this particular fund, and so on is normally not well gotten.

Numerous funds like to put prospects under pressure, and screening numerical abilities are an excellent way to do this. Arithmetic concerns, brainteasers, doing basic LBO modelling in your head and converting Cash on Cash returns toIRRs must be something you are extremely comfortable with. If not – do practice! Also, when asked technical concerns or mathematical questions, it is definitely fine to take a little time to respond to.

While all of the above errors involve some lack of preparation, another warning in private equity interviews is overconfidence and conceit, which can really be fairly typical in interviews. Make certain that you are not leaning back on your chair, o not be overfriendly with the senior members of the group, and, at all times, make sure that you show that you are very keen to get the task.

Nevertheless, there are some significant distinctions in skillset and culture in between those 2 professions. Often, private equity companies would like to work with lenders “early,” i – loans athletes sports.e. after one or two years’ experience at an investment banks. The factor is that those firms are often scared that a prospective hire who has actually invested too much time in investment banking will get a “banker frame of mind”.

A lot of investment bankers tend to be deal-driven. The “cravings” to close many big deals is really a weak point in private equity since it’s not about creating charges any longer. Private equity experts require to do great offers and be ready to step back even after months of effort if the offer will not create enough returns.

Private equity is not betting or even equity capital investing in which you would normally anticipate a few losses. Private equity is about generating consistent high returns with minimum risk. While the pay may be a bit higher or lower in PE (depending upon the fund size), the cash is made from the “bring”, i.e. securities fraud theft.

Business Development In Private Equity – The Rise Of The Deal

This bring is made in time, so it doesn’t make good sense to jump from one place to another anymore – securities exchange commissio. A bad year in banking may trigger you to alter your company, however a bad year in private equity will just be a truth of life and you require to take a more long-term view.

While lots of lenders are excellent at modelling, private equity modelling tends to be much more comprehensive and focus on entirely various problems. Modelling in private equity typically depends upon designing the optimal capital structures (debt/equity) and also the incentive structures (choice shares, benefits, management equity, and so on). The modeling tends to be much more intricate and in-depth, so presumptions in your operating design will be challenged by the team and due diligence advisors.

Particular funds can have their own timelines, investment goals, and management philosophies that separate them from other funds held within the very same, overarching management firm. Successful private equity companies will raise many funds over their lifetime, and as firms grow in size and complexity, their funds can grow in frequency, scale and even specificity. For more information about securities exchange commission and - visit his websites and -.

In 15 years of handling properties and backing numerous business owners and financiers,Tyler Tysdal’s companies co-managed or handled , non-discretionary, approximately $1.7 billion in properties for ultra-wealthy households in industries such as health care, oil and gas , real estate, sports and home entertainment, specialized lending, spirits, technology, durable goods, water, and services companies. His team advised clients to invest in almost 100 entrepreneurial business, funds, private loaning deals, and real estate. Ty’s track record with the private equity capital he released under the very first billionaire customer was over 100% annual returns. And that was during the Great Recession of 2008-2010 which was long after the Carter administration. He has produced numerous millions in wealth for clients. Nevertheless, given his lessons from dealing with a handful of the certified, extremely sophisticated people who could not seem to be pleased on the advantage or understand the potential drawback of a deal, he is back to work exclusively with business owners to assist them sell their companies.

Being innovative and entrepreneurial are extremely preferable characteristics for a lot of PE funds. Finding deals, networking, creating originalities, and considering all kinds of dangers and chances around deals and business can make a significant difference to the profitability of the firm. Also, private equity specialists require to understand the in-depth elements of supervising business; therefore professionals with some start-up or entrepreneurial experience are valued because they understand all of those crucial information. invested $ million.

Even if you go to a smaller firm, you will still work a great 60+ hours per week and your schedule will stay somewhat unforeseeable due to due diligence meetings, management conferences, and other deal-related, last-minute demands. While the way of life is better, you’re still working in a deal-driven environment. The base income and bonus offer structure might not vary that much from that in banking, however the cash in private equity is made when a fund closes and when exits are made.

What matters most now is the fund performance, not your own private accomplishment. You may have developed the very best designs and dealt with the biggest offers, but if the returns are not there, you will not get paid. The amount of grunt work absolutely reduces in private equity. There are fewer administrative jobs, printing of books, and numerous people-intensive tasks can be contracted out to banks and advisors.

reviewing NDAs, term sheets) and making presentations to the financial investment committee. Discovering deals is something totally new for financial investment lenders. While you will not be expected to bring deals right away, ultimately the staff member will expect you to be able to build relationships with lenders and screen through the deals to discover some that are appealing, and likewise to cold call or approach business straight.

Social life in financial investment banking can really be rather amazing. You’re operating in companies with countless staff members; there are many peers to go over and to share your war stories with, junior lenders are normally all below 30 and there is a work hard/play tough mindset. Also, the turnover is rather high in banks; new analyst and associate classes arrive every year, so it can be a really revitalizing environment.

The Strategic Secret Of Private Equity

Teams are little (possibly 10 to 30 people), a number of the partners and senior investors are much older, and individuals don’t truly move upward or downward. Considering that the normal profiles of private equity experts tend to be rather “basic” (i.e. top school, investment banking/strategy consulting background, etc.), therefore social life tends to be less enjoyable. https://www.youtube.com/embed/WhJVIagxxwk

Interaction abilities and individual skills are very essential in private equity. You can be a top modeller and be exceptionally dedicated. Nevertheless, to convince the financial investment committee, get people in the firm to support you, get the management team to work with you, and find out the finest deals from the intermediaries, you will require for individuals to like you – investment fund manager.

Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Way Of Life 1 Way Of Life 1 Way of life 1 Way of life 1 Lifestyle 1 Way of life 1 Lifestyle 1 Way Of Life 1 Profession Avcice 1 Career Advice 1 Profession Avcice 1 Career Advice 1 Profession Avcice 1 Books 1Books 1Books 1 Books 1Books 1Books 1 Books 1Books 1Books 1 Books 2 Books 2 Books 2 Books 2 Books 2 Books 2 Questions 1 Questions 1 Questions 1 Questions 1 Questions 1 Questions 1.

-

Who Needs The Services of an Injury Lawyer?

Neinstein Personal Injury Lawyers Toronto

Diamond Personal Injury Lawyers …

Diamond Personal Injury Lawyers …If you were the victim of an awful accident or (even worse) lost a loved one in death, you have your mind focused on lots of matters and feelings happening at the same time. This is where The Decker Law office can make all the distinction. We can look after the legal procedure with essential objectivity and help you make it through this uncomfortable time.

Passing through the world of legalese, with all its complex lingo, can be an outright nightmare for the typical person. And aside from jargon, there are techniques and contacts we understand and take advantage of frequently to rapidly get through the “bureaucracy” that insurance provider and hospitals put up to limit details or obscure the complete extent of your injury (neinstein and associates).

Neinstein Medical Malpractice Attorneys Ontario Canada

With the huge majority of individual cases settling before going to trial, The Decker Law practice will stick to you to the end. Our experience and intimate knowledge of Virginia law makes sure that you get the compensation you are worthy of and the complete extent of legal recourse possible. We’re all set to go to court and battle for your case if that is what the scenario needs.

And we’ll get your settlement to you in a prompt manner. If you suffered an injury due to another person’s negligence, it’s great to know the personal injury law essentials. If you require an injury lawyer, our group is all set to help. Contact us today by means of text (SMS), Chat, Phone or Email (neinstein reviews).

Peterborough Neinstein Personal Injury Lawyers

This page goes over types of personal injury cases and an overview of the process that an injured victim may have to go through to achieve recovery. If you are looking for a and surrounding locations, offer us a call today for a complimentary case review, 919-615-3095.Jack Keener, lawyer in Ontario at Law, manages Personal Injury cases for The Bishop Law Company.

Neinstein Personal Injury Lawyers …

Neinstein Personal Injury Lawyers …Anyone who is injured due to the negligence of another through no fault of their own can potentially have an accident case in North Carolina. NC is a contributory negligence state, suggesting if the hurt person is even 1% at fault, they can not recuperate on an injury case (however see Last Clear Opportunity Doctrine). For car mishap cases, the officer will often release a citation to the at-fault party, however not constantly.

Neinstein Personal Injury Attorneys Hamilton

Ottawa-Neinstein Personal Injury Attorneys

Toronto based law firm Neinstein has a excellent reputation. Email Neinstein’s law firm in one of their Ontario offices. Neinstein Personal Injury Lawyers has handled severe injury claims across Ontario for 5 Decades. Its locations of competence include medical, legal, and insurance coverage issues connected to medical carelessness, motor vehicle mishaps, disability claims, slip and falls, item liability, insurance coverage disagreements, and more.Though work injuries are generally governed under NC Workers’ Payment, there are particular scenarios under which you can have a personal injury case for injuries you sustained on the task. For instance, if you are a delivery chauffeur and enter a motor vehicle accident while performing your task tasks (through no fault of your own), you might be qualified for Employee’s Settlement through your employer and may also be entitled to settlement through a injury case versus the at-fault chauffeur.

According to N.C.G.S.1-52 (16 ), the basic rule for filing an injury court case in North Carolina is 3 (3) years from the date of the accident. Suing with the insurer is not the exact same thing as submitting a court case. If you do not file your case in the suitable court within the appropriate statute of restrictions, you will be disallowed from recovery.

Ottawa Neinstein Personal Injury Lawyers

There are some exceptions to the 3 (3) year time frame. If a small is hurt as the result of another’s neglect, the 3 (3) year statute of limitation does not start to run until the small’s 18th birthday – neinstein and associates llp. On the other hand, if somebody passes away as the result of the carelessness of the at-fault celebration, the deceased’s representative, normally the administrator or administrator of the estate, has just 2 (2) years from the date of the individual’s death to submit a wrongful death action in the appropriate court.

The more severe your injuries, the longer you will need to receive medical treatment for them. It is risky to settle your case without including the expense of all your medical treatment: past, present and future. On average, NC Personal Injury Cases can take a year to settle without the requirement of going to trial.

Windsor Neinstein Personal Injury Lawyers

Neinstein Personal Injury Lawyers …

Neinstein Personal Injury Lawyers …The decision to pursue litigation should be discussed with a Raleigh Injury Lawyer. A victim can assert a claim versus the at-fault celebration for losing time from work due to the fact that of his/her injuries. In order to look for recovery for lost wages, a hurt individual needs to document the actual days he/she missed out on due to their major injury and this must be confirmed by their employer.

Neinstein Personal Injury Lawyers …

Neinstein Personal Injury Lawyers …Self used individuals should read Lost Earnings and Making Capability (neinstein lawyers). Pain and Suffering in NC injury cases covers the physical pain and psychological suffering that a victim has to endure due to the injury they have actually sustained. If you break your leg, you will experience not just physical discomfort but likewise psychological and emotional distress.

Neinstein Medical Malpractice Attorneys Sudbury

You might develop anxiety, stress and anxiety, vehophobia or post-traumatic tension disorder after your injury. This is what discomfort and suffering damages attempt to compensate you for. In North Carolina, the at-fault celebration is accountable for paying accident-related medical expenses that resulted from the at-fault celebration’s negligent actions. However, getting compensation from the at-fault driver’s insurance provider can be a lengthy procedure, and medical service providers wish to be paid immediately for their rendered services.

There are no laws in North Carolina that avoid individuals who have actually been hurt in a vehicle mishap from filing their accident-related medical treatment with their own health insurance coverage company. In many cases an accident victim’s health insurance business will pay some, if not all of their accident-related medical expenditure.

Neinstein Personal Injury Lawyers London

Read Medical Costs After a NC Automobile Mishap. Unfortunately, persistent conditions from mishap injuries can develop and lead to life-long disability (i.e. spine injury or distressing brain injury). The cost of past, existing and future medical costs ought to be considered when thinking about settling an accident claim (gary neinstein suspended).

Damages for injury includes fair settlement for the scarring or disfigurement which a victim suffers as a near outcome of the at-fault party’s neglect. Similar to pain and suffering settlement, the amount of compensation for long-term scarring or disfigurement is figured out by the level of the change of the claimant’s physical appearance, and the humiliation and mental suffering the person will sustain as a proximate result of the wrongful conduct.

London Neinstein Personal Injury Lawyers

Review - Neinstein Medical Malpractice Attorneys Barrie Canada.

Managing partners Jeff Neinstein and Greg Neinstein lead the Neinstein Accident Attorneys group. Together, they have years of experience in injury law and have represented customers in lots upon dozens of jury and non-jury trials. Contact Jeffrey Neinstein, from Neinstein Lawyers for details. The group from Neinstein Personal Injury Lawyers appears at all levels of court: provincial courts, appellate courts, the even the Supreme Court of Canada. We also represent clients prior to administrative tribunals such as the Financial Providers Commission of Ontario (FSCO) and pursue mediation, arbitration, and alternative disagreement resolution approaches when possible.

To be awarded punitive damages, your lawyer should initially prove the accused is accountable for offsetting damages and a minimum of one annoying aspect existed and related to your injuries for which you were granted damages. The irritating aspect(s) should be shown by clear and persuading proof. If you read this page, you may be wondering why or when you must employ a NC Accident Lawyer. Everyone does not require to work with an injury lawyer in Ontario to settle their case.